65, Change, and Chill: What Singapore’s Upcoming CPF Shifts Mean for Your Retirement (and Why Porridge Isn’t a Plan)

I never thought contemplating retirement would remind me of my grandfather’s legendary sweet potato porridge diet—but here we are. If you’re anywhere near 65 or just playing the long game, Singapore’s CPF system is about to spring some surprises in 2025. Between salary ceilings jumping, account closures (farewell, Special Account!), and new ways to stretch your savings, it’s frankly enough to make anyone wish for an extra scoop of rice. But don’t panic (yet): Let’s break down the changes, the quirks, and a few unexpected ways these rules nudge us toward smarter, not scarier, golden years.

1. The 65 Milestone: Why Is Everyone Talking About CPF Changes for 2025?

Turning 65 in Singapore isn’t just about free bus rides or senior discounts at the hawker centre. It’s the age when the Central Provident Fund (CPF) system really kicks into high gear, and 2025 is shaping up to be a game-changer for anyone approaching this milestone. If you’re in your 60s, or already at 65, you’re probably hearing a lot about CPF changes—especially around the Retirement Account savings cap, the closure of the Special Account, and new rules for your monthly salary ceiling. So, what’s all the fuss about? Let’s break it down in simple terms.

Why 65 Is More Than Just a Number

Reaching 65 is a big deal because it’s when you officially join CPF LIFE, Singapore’s national lifelong annuity scheme. This means you start getting a steady stream of monthly payouts—your safety net for daily expenses like food and transport. But 2025 brings fresh rules that could seriously impact how much you get and how you plan.

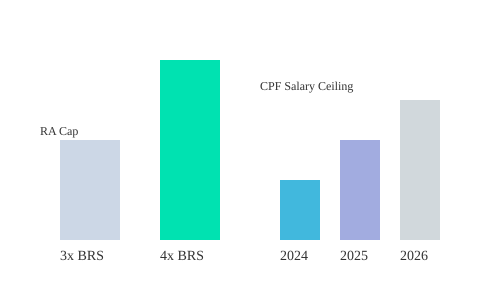

Retirement Account Cap: From 3x to 4x BRS (SGD 426,000 in 2025)

One of the most talked-about changes is the increase in the Retirement Account savings cap. Previously, you could only top up your Retirement Account (RA) up to three times the Basic Retirement Sum (BRS). In 2025, this jumps to four times the BRS—which means a new cap of SGD 426,000. That’s a significant boost, giving you more room to grow your nest egg and secure higher CPF LIFE payouts. If you’re keen to maximize your retirement income, this is your window to top up more than ever before.

CPF Special Account Closure: What Happens to Your Money?

Here’s another biggie: From mid-January 2025, your CPF Special Account (SA) will close once you turn 55. Any funds left in your SA will be transferred to your Retirement Account (up to the new cap), and any excess goes to your Ordinary Account. This is a major pivot point. For years, the SA was a safe haven for higher interest rates. Now, you’ll need to rethink how you manage your savings after 55, as the SA will no longer be an option for growing your retirement funds.

CPF Monthly Salary Ceiling: More Room for Savings

Good news if you’re still working: the CPF monthly salary ceiling is rising again. In 2025, it’ll go up to S$7,400, and by 2026, it’ll hit S$8,000. This means higher CPF contributions for those earning more, which helps you build up your retirement savings faster. If you’re in your peak earning years, this change is designed to help you save more for your golden years—without even thinking about it.

Property Monetization: Silver Housing Bonus & Lease Buyback Scheme

Worried about outliving your savings? CPF’s housing support schemes are here to help. The Silver Housing Bonus scheme lets you unlock cash by right-sizing to a smaller flat, while the Lease Buyback Scheme allows you to sell part of your flat’s lease back to HDB for a lump sum and higher CPF payouts. Both options can boost your retirement income, giving you more flexibility and peace of mind.

Retirement Isn’t Just About Surviving—It’s About Living

I recall my grandfather surviving on sweet potato porridge—not the retirement anyone dreams of.

That’s why these CPF changes matter. They’re designed to help you avoid a bare-bones retirement and instead, provide stability and dignity in your later years. Housing, healthcare, and monthly income—CPF covers all three, so you don’t have to rely on just porridge and hope.

- Retirement Account savings cap: Up to 4x BRS (SGD 426,000 in 2025)

- CPF Special Account closure: For 55+, funds move to RA or OA from mid-Jan 2025

- CPF monthly salary ceiling: S$7,400 (2025), S$8,000 (2026)

- Property monetization: Silver Housing Bonus and Lease Buyback Scheme

Turning 65 in 2025? These changes are your chance to plan smarter, save more, and retire with confidence.

2. Are You Really Ready for Longer Lives and Bigger Bills? Charting Longevity, Inflation, and Retirement Income

Let’s be honest: most of us have a number in our heads for how long we’ll live. Maybe it’s based on your parents’ age, your own health, or just a gut feeling. But here’s the reality check—Singaporeans are living longer than ever, and the bills are only getting bigger. If you’re banking on a “porridge plan” for your golden years, it’s time to look closer at how longevity and inflation could eat away at your comfort, and how CPF LIFE retirement income plans are designed to keep you covered.

Singaporeans Are Living Longer Than They Think

When asked, most people estimate they’ll live into their 80s, often basing it on family history or current health. But the stats tell a clearer story:

| Life Expectancy at 65 | Median Age (50% live past) |

|---|---|

| Men | 84 |

| Women | 87 |

That means if you’re 65 today, there’s a 50% chance you’ll live past 84 (if you’re male) or 87 (if you’re female). Many people underestimate actually how long they live and they do not actually set aside enough. This is a common pitfall—if you plan for less, you risk running out of savings when you need them most.

Inflation: The Silent Erosion of Your Retirement Comfort

It’s not just about living longer—it’s about affording life as it gets more expensive. Inflation quietly eats into your purchasing power, making everything from food to transport to leisure cost more over time. Here’s a simple illustration:

| Today’s Cost | Future Cost (with inflation) |

|---|---|

| $1,000 | $1,520 |

So, if you think you can get by on $1,000 a month today, you’ll need $1,520 to buy the same basket of goods in the future. That “porridge and sweet potato” budget? It’s shrinking every year. And if you’re not planning for this, you could end up cutting back on essentials or missing out on the retirement lifestyle you’ve worked so hard for.

Why CPF LIFE Retirement Income Plans Matter

This is where CPF LIFE comes in. Unlike traditional savings or investments, CPF LIFE is designed to provide you with lifelong monthly payouts—no matter how long you live. It’s a national annuity scheme that protects you against the risk of outliving your savings (also called “longevity risk”).

- CPF LIFE monthly payouts start from age 65 (or later if you choose), and continue for as long as you live.

- Your payouts are calculated based on how much you have in your Retirement Account at age 65.

- If you have at least $60,000 in your Retirement Account, you’ll be automatically enrolled in CPF LIFE between ages 65 and 70.

- Even if your own savings run out, CPF LIFE keeps paying you.

Think of it as a safety net that adjusts for the uncertainty of life. You don’t have to worry about guessing your “expiry date”—CPF LIFE has you covered.

Planning for the Right Retirement Account Savings Limit

So, how much do you really need? Here’s a quick guide:

- To receive a monthly payout of $1,600–$1,700, you’ll need about $319,000 in your Retirement Account at age 65.

- If you set aside the Full Retirement Sum at 55 ($213,000 for this year), you can expect a payout of $1,200–$1,300 monthly.

- Want more? Top up to the Enhanced Retirement Sum for higher payouts.

But remember: inflation impact on retirement means you should aim higher than today’s comfort level. Your future self will thank you for planning ahead.

Choosing the Right CPF LIFE Plan to Beat Inflation

Worried about inflation eating away at your payouts? CPF LIFE offers an Escalating Plan where your monthly payouts increase by 2% each year. This helps your income keep pace with rising costs, so you don’t have to downgrade your lifestyle—or your meals—as you age.

Most people underestimate actually how long they live and they do not actually set aside enough.

Don’t let that be you. With the right planning and the right CPF LIFE retirement income plan, you can look forward to more than just porridge in your retirement years.

3. From Porridge to Property: Creative Ways CPF Lets You Boost Retirement Security

Let’s be honest—surviving on porridge alone isn’t anyone’s dream retirement. Thankfully, Singapore’s CPF system offers far more creative (and robust) ways to turn your hard-earned savings and even your home into a steady stream of retirement income. If you’re approaching 65, or just planning ahead, here’s how you can make your CPF work harder for you—so you can chill, not just survive.

Monetizing Your Flat: Silver Housing Bonus Scheme & Lease Buyback Scheme

Your HDB flat isn’t just a roof over your head—it can be a powerful tool to boost your retirement security. The Silver Housing Bonus scheme and the Lease Buyback Scheme (LBS) are two CPF-linked options that let you unlock your property’s value without selling it outright or moving out of your beloved neighborhood.

With the Silver Housing Bonus, if you right-size to a smaller flat, you can receive a cash bonus of up to $30,000. The proceeds from your sale are channeled into your CPF Retirement Account (RA), directly increasing your CPF LIFE payouts. The Lease Buyback Scheme lets you sell part of your flat’s lease back to HDB, turning a portion of your flat’s value into cash—again, with proceeds topping up your RA. Both schemes mean you’re not just sitting on property wealth; you’re converting it into monthly income you can actually use.

CPF LIFE Retirement Income Plans: Standard, Escalating, and Basic

Once your CPF Retirement Account is topped up—whether from property proceeds, work contributions, or voluntary top-ups—you’ll need to choose a CPF LIFE retirement income plan. There are three main options: Standard, Escalating, and Basic (also known as the legacy plan).

The Standard Plan gives you a steady, level payout every month for life. It’s simple and predictable, but keep in mind that inflation can erode your purchasing power over time.

The Escalating Plan is designed for those who worry about rising costs as they age. As one CPF expert puts it:

If you’re worried about things being more expensive as you age, the escalating plan helps keep pace with inflation.

With this plan, your monthly payout grows by 2% each year. For example, if you start with $1,000 per month at age 65, you’ll be receiving about $1,500 per month by age 85. This partial inflation hedge means you’re less likely to feel the pinch as living expenses go up.

The Basic Plan (legacy plan) works a bit differently. Only 10–20% of your RA savings are transferred into the CPF LIFE fund, while the rest stays in your account. You’ll draw from your own savings first, then from the pooled fund. Even if your personal savings run out, you’ll continue to receive payouts for life, thanks to the risk-pooling nature of CPF LIFE.

Healthcare: MediShield Life and Integrated Shield Plans

Retirement isn’t just about income—it’s also about peace of mind. That’s where MediShield Life and Integrated Shield Plans come in. MediShield Life provides basic hospital coverage for all Singaporeans, regardless of age or health. But as you get older, medical needs often increase, and bills can pile up. Integrated Shield Plans offer extra protection, letting you access better wards or private hospitals if you wish. Remember, insurance isn’t a luxury—it’s essential coverage that protects your retirement nest egg from being wiped out by unexpected health costs.

CPF Nomination Process: Protecting Your Loved Ones

Finally, don’t forget the CPF nomination process. If you haven’t nominated your beneficiaries, your CPF savings could be tied up for months, leaving your family in a bind. It’s quick and easy to do online, and ensures your hard-earned money goes straight to your loved ones, not through lengthy legal processes.

In conclusion, Singapore’s CPF system is much more than a forced savings plan. With smart use of the Silver Housing Bonus scheme, Lease Buyback Scheme, CPF LIFE retirement income plans, and proper insurance and nominations, you can turn your assets into a secure, flexible retirement. So, ditch the porridge plan—embrace the property, protection, and payout options CPF offers, and look forward to a retirement that’s truly chill.

TL;DR: Big CPF tweaks are landing in Singapore come 2025—think new savings limits, the goodbye to Special Accounts, better options for property monetization, and more. Know the nuts and bolts now, so you can retire with more food than just porridge on the table.

A big shoutout to https://www.youtube.com/watch?v=9LdKo504rWw for the valuable content. Be sure to check it out here: https://www.youtube.com/watch?v=9LdKo504rWw.