Maximize Your Savings Potential with These Tips

Effective Savings and Financial Growth Strategies The significance of saving in the current fast-paced financial environment cannot be emphasized enough. It is crucial to have a well-defined plan, whether you are preparing for retirement, an emergency fund, or a significant purchase. In order to make sure you are prepared to reach your financial objectives, this article will examine several ways to improve your investment and savings strategies. CPF Retirement Planning is crucial for securing a comfortable future in Singapore.

Key Takeaways

- Set clear savings goals to give yourself a target to work towards

- Create a budget and stick to it to ensure you are saving consistently

- Automate your savings to make it easier to stay on track with your goals

- Take advantage of employer matching contributions to maximize your savings potential

- Cut unnecessary expenses to free up more money for saving and investing

Setting specific savings objectives is the first step in a successful financial plan. It can be difficult to maintain motivation and monitor your progress if you lack clear goals. Decide what you want to save for first.

This could be anything from short-term objectives like a new car or vacation to long-term goals like home ownership or retirement funding. You can make a plan that directs your saving efforts by establishing these objectives. Once your objectives have been determined, it is essential to measure them.

If your goal is to save for a down payment on a home, for example, figure out how much you’ll need and establish a deadline for reaching it. Calculating how much you must save each month in order to meet your goal by a given date may be one way to do this. You can stay motivated & focused while acknowledging each small victory along the way by dividing more ambitious objectives into more manageable benchmarks. Making a budget is a crucial first step in efficiently handling your money. By keeping track of your earnings and outlays, a well-organized budget makes sure that you put money aside for your savings objectives.

| Tip | Description |

|---|---|

| Set a Budget | Creating a budget helps you track your expenses and identify areas where you can save. |

| Automate Savings | Set up automatic transfers to your savings account to ensure consistent savings. |

| Reduce Unnecessary Expenses | Identify and cut out unnecessary expenses to free up more money for savings. |

| Take Advantage of Employer Match | If your employer offers a 401(k) match, contribute enough to maximize the match for extra savings. |

| Shop for Better Deals | Regularly review your bills and shop around for better deals on services like insurance and utilities. |

Sort your expenses into fixed (like rent or mortgage payments) and variable (like groceries and entertainment) categories after you have listed all of your sources of income. You can find areas where you can make savings by using this thorough overview. It takes self-control & frequent review to stay within your budget. Use apps or budgeting tools that allow you to keep an eye on your spending in real time.

These tools frequently give you information about your spending patterns, enabling you to decide where to make budget adjustments. Setting aside time each month to review your budget can also help you maintain accountability & make the required modifications in response to shifts in your income or spending patterns. Automation is among the best strategies to guarantee steady saving.

Saving money can be a smooth part of your financial routine if you set up automatic transfers from your checking account to your savings account. In addition to making things easier, this approach lessens the temptation to spend money that could be saved. Numerous banks provide tools that let you plan these transfers for weekly or monthly intervals, lining them up with your paychecks for maximum effectiveness.

Also, you can accumulate an emergency fund without even considering it by automating your savings. For instance, you can accumulate $1,200 without any further work at the end of the year if you set up an automatic transfer of $100 each month into a different savings account. This strategy guarantees that you prioritize your financial objectives without running the risk of procrastinating and encourages the habit of saving.

It is important to make the most of matching contributions to retirement accounts, such as a 401(k), if you are fortunate enough to work for an employer that provides them. In essence, employer matching is free money that, over time, can greatly increase your retirement savings. For example, if your employer matches 50% of your contributions up to 6% of your pay, making a minimum contribution of 6% guarantees that you are taking full advantage of this benefit.

Contribute enough to satisfy the match requirement as soon as you can in order to maximize your employer matching contributions. If you can’t contribute the entire amount at first, think about boosting your contributions over time as your financial situation improves. Thanks to your contributions and the extra money your employer provides, this strategy can eventually result in a significant increase in your retirement savings.

One of the most important steps in increasing your potential for savings is recognizing and eliminating wasteful spending. Start by going over your monthly expenses and identifying areas where you can cut back without compromising your standard of living. Take cutting back on eating out or terminating subscriptions you don’t often use, for instance.

Over time, even minor adjustments can add up to substantial savings. Having a minimalist mindset when making purchases is another successful tactic. Ask yourself if a non-essential purchase is an impulse buy or if it fits with your financial objectives before making it. A waiting period, like thirty days, can help you avoid impulsive purchases and give you time to consider whether the item is really necessary.

Over time, being an astute consumer can result in significant savings. Before making a purchase, start by comparing prices from several retailers; this easy step can frequently highlight notable price variations for the same product.

Another efficient strategy to save money when shopping is to use coupons and cashback offers. A lot of stores provide digital coupons that are simple to use on their websites or mobile applications. You can also get paid back for purchases you make at participating stores by using cashback apps. By integrating these tactics with astute purchasing practices, you can optimize your savings while continuing to take advantage of the goods and services you adore. Every savings account is different when it comes to saving money.

With much higher interest rates than traditional savings accounts, high-interest savings accounts enable your money to grow more efficiently over time. Find accounts with competitive interest rates and low fees by researching different banks and credit unions. Many high-interest savings accounts offer restrictions on withdrawals or tiered interest rates according to account balances, among other features that encourage saving discipline, in addition to higher interest rates.

By using these accounts, you foster an environment that promotes long-term financial growth in addition to increasing the amount of money you save. Investing is essential to gradually increasing wealth. A safety net and short-term financial security are provided by saving, but compound interest and market appreciation enable investing to grow your money much more quickly.

Start by learning about the various investment vehicles, including mutual funds, stocks, bonds, & real estate. The secret to smart investing is diversification. Investing across a range of sectors and asset classes allows you to maximize potential returns while reducing risk. For example, think about putting some of your money into stocks for possible growth and some into bonds for stability. Consider using tax-advantaged accounts, such as 401(k)s or IRAs, to further improve your investing approach.

In conclusion, putting these tactics into practice can greatly improve your capacity to save money and make prudent investments for long-term growth. You can build a strong financial foundation that supports both immediate needs & long-term goals by establishing clear goals, making a budget, automating savings, utilizing employer contributions, reducing wasteful spending, shopping sensibly, making use of high-interest accounts, and investing sensibly.

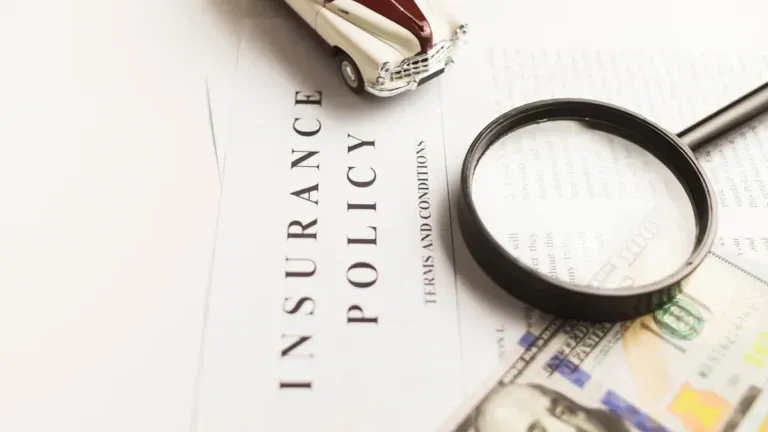

If you’re looking to grow your savings effectively, it’s essential to understand the various financial tools and policies available to you. One such policy is CareShield Life, which plays a crucial role in long-term care planning in Singapore. For a comprehensive guide on this topic, you can read the article titled “Understanding CareShield Life: Your Guide to Long-Term Care Planning in Singapore.” This article provides valuable insights into how CareShield Life can be integrated into your financial planning strategy to ensure a secure future. You can access the article by clicking on this link: Understanding CareShield Life: Your Guide to Long-Term Care Planning in Singapore.

FAQs

What are some ways to grow savings?

Some ways to grow savings include setting a budget, cutting unnecessary expenses, increasing income, and investing in assets such as stocks, bonds, or real estate.

Why is it important to grow savings?

Growing savings is important to build financial security, achieve financial goals, and be prepared for unexpected expenses or emergencies.

What are some common mistakes to avoid when trying to grow savings?

Common mistakes to avoid when trying to grow savings include not having a clear savings goal, not sticking to a budget, and not taking advantage of investment opportunities.

How can I start growing my savings if I have limited income?

Even with limited income, you can start growing your savings by setting a budget, cutting unnecessary expenses, and finding ways to increase your income, such as taking on a side job or freelance work.

What are some long-term strategies for growing savings?

Long-term strategies for growing savings include investing in retirement accounts, diversifying investments, and consistently saving a portion of your income.